Search

Unlike casual gaming, esports involves professional players, structured tournaments, and often large audiences, both online and in-person, akin to traditional sports events. With its own ecosystem of leagues, sponsors, and media coverage, esports has evolved into a global phenomenon, drawing...

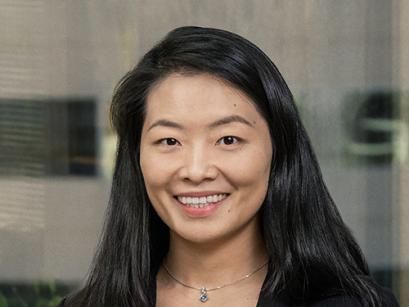

Cynthia Gomez will be a Panelist at the October 18th CLE Luncheon Hosted by the American Immigration Lawyers Association in Miami, FL. Cynthia will be one of four panelists, along with leaders from the Customs and Border Patrol offices in South Florida. The topic for Cynthia's panel is Department of...

Al Chakravarty helps to protect and defend organizations and individuals from issues that are enforced by federal and state agencies, including regulatory and compliance issues, whistleblower complaints, national security concerns, allegations of anti-competitive behavior, executive or employee...

Extensive Government and Internal Investigation Experience. Notable Results. White collar defense and regulatory issues can arise without warning, and require experience, finesse, and judgment to resolve favorably. Whether it is a search warrant, “target letter,” “Wells Notice,” subpoena...

Ted Baines is a partner and past chair of Saul Ewing's Litigation Department. He focuses his litigation practice on commercial contract, insurance, shareholder disputes, including shareholder demand responses, real estate, construction, and the defense of mass torts involving deaths or catastrophic...

Charlie Monk handled complex, high-stakes litigation, but is now limiting his practice to strategic consulting assignments. During his 50 years as a trial lawyer, clients ranging from governmental entities and security broker dealers to energy providers and utilities have relied on his legal counsel...

Navigating the Complex World of Tax Law Saul Ewing's Tax Practice offers focused, in-depth knowledge of the intricacies associated with federal, state, and local tax law. The role of the Tax Practice is to provide clients with advice and representation in a wide variety of tax-related legal issues...

Cynthia Gomez practices primarily in the area of business immigration law, but also represents clients in their family-based and removal defense matters before USCIS, EOIR and the BIA. Specialties include: E-2 Treaty Investor Visas at various Consular Posts; Extraordinary Ability Visas (O-1 and EB-1...

Geoff Gamble is a litigator who focuses on insurance disputes, consumer financial services matters, and shareholder issues. He has extensive experience handling these and other complex commercial matters in federal and state courts and before private arbitration panels. Geoff represents insurance...

Robert E. McKenzie concentrates his practice in representing clients before the Internal Revenue Service and state agencies. He has lectured extensively on the subject of taxation. He has presented courses before thousands of CPAs, attorneys and enrolled agents nationwide. Robert is recognized as an...

Protecting the Rights of Corporate Clients Companies generally enjoy a fruitful relationship with their shareholders, but disagreements about management, perceptions of minority shareholder mistreatment, or concerns over executive compensation may arise. No matter the cause of shareholder...

Harry Shapiro's practice focuses on taxation law, tax litigation and tax-exempt financing law. He has handled matters for multinational companies, non-U.S. corporations having U.S. businesses, pass-through entities, professional associations and wealthy individuals, as well as for numerous tax...

Yuan (Dora) Wang possesses a background encompassing both corporate and immigration law. Leveraging this combination of experience, Dora provides legal guidance to clients traversing intricate legal terrains. This background equips Dora to deliver comprehensive legal solutions to clients involved in...

Kate Dosmanova advises companies and other entities in the United States and abroad on U.S. immigration and nationality laws, regulations and policies and guides them on their compliance. Her experience includes matters involving visa and work permits, including employment eligibility verification...

Rohit Kapuria focuses his practice in general corporate and securities law, representing both public and private companies in connection with mergers and acquisitions, public and private offerings of securities and SEC disclosure, and corporate governance. His corporate/securities practice also...

Minjae Kim maintains a broad civil litigation practice, assisting clients from pre-litigation investigation through appeal in complex commercial, intellectual property, and tax disputes. She has experience drafting dispositive motions, appellate briefs, and critical pleadings in state and federal...

Immigrating to the U.S.? Don’t Forget about Tax. Immigrating to the United States has many wonderful benefits, but it also includes some challenges. When a person comes to the U.S. as a resident, that person must comply with U.S. tax rules, including paying taxes on world-wide income. U.S. tax law...

Thomas Cryan advises Fortune 100 clients and other large employers on legal issues connected with executive compensation, fringe benefits, employment tax and related government reporting. Drawing on more than 25 years of practice, Tom works closely with the legal, tax and benefits departments for...

Peter Zlotnick is a complex corporate and commercial, real estate, construction and health care litigator. He has more than 25 years of legal experience advocating on behalf of and advising high net worth individuals, as well as public and private business entities, private equity firms and...

Jamihlia Johnson helps multi-national companies and high-net worth clients navigate complex tax controversies with federal and state agencies and provides legal advice to guide their development of tax planning strategies and compliance. With experience representing clients in the United States...